Domestic Tariff Area Under GST in India

- 8 Oct 25

- 8 mins

Domestic Tariff Area Under GST in India

Key Takeaways

- A Domestic Tariff Area (DTA) under GST is a region where businesses operate under standard customs duties and GST without tax exemptions.

- Unlike SEZs, DTAs follow regular trade regulations, contributing significantly to government revenue through GST and customs duties.

- DTA zones play a key role in Indian trade by supporting local manufacturers, boosting employment, and balancing domestic consumption with exports.

- Businesses in DTAs must comply with GST laws, Customs Act, and Foreign Trade Policy for smooth trade operations.

- The difference between DTA, SEZ, and EOU lies in tax benefits, regulatory framework, and export obligations under India’s trade policy.

A Domestic Tariff Area under GST (Goods and Services Tax) is a specific part of the country with specially designed trade regulations. These regions do not enjoy tax exemptions. As a result, they operate with standard tax regulations within the country. Learn in detail about Domestic Tariff Areas here to check your eligibility as a business owner.

What is DTA Zones?

DTA (Domestic Tariff Area) is a part of the country that is not entitled to special trade rules. These are domestic markets where goods are produced as well as consumed. However, DTA does not offer tax reliefs or duty exemptions unlike Special Economic Zones (SEZ).

DTA zones foster regular trade and commerce within a country without the complexities of exemptions, unlike SEZ. The normal trade policies followed in DTA zones help maintain an equilibrium between export-oriented trade and domestic trade. Further, as DTA zones are not tax-exempt, they significantly contribute to government revenue for national growth.

History of DTA

DTA is a part of India’s customs and taxation policies. The preliminary concern pertaining to DTA establishment was to create regions which continue trade under standard customs duties, unlike SEZ. Notably, SEZ operates with several tax and regulatory exemptions to facilitate exports and drive foreign investment.

Here is a brief history of DTA:

In the 1960s, the concept of DTA was established to distinguish between export zones and domestic market areas wherein the regulations for DTA were set up. 1991 marked the formal mention of DTA regulations in the Foreign Trade Policy and Customs Act, 1991. In the 2000s, the DTA zones were clearly highlighted within domestic trade policy with an expansion in India’s industrial and trade prospects.

Role of DTA in Indian and Global Trade

DTA plays an important role in Indian and global trade wherein it contributes to the local economy through a continuous supply of goods within the nation. Here is its role in Indian and global trade:

DTA in Indian Trade

Here is DTA’s role in Indian trade:

● As DTA operations are not tax-exempt, they contribute significantly to the government's revenue. The taxes include GST (Goods and Services Tax), import and export duties and other domestic taxes.

● It ensures that there is a trade balance between domestic industries where goods are produced and consumed ensuring no distortion due to tax regulations.

● DTAs boost Indian manufacturers and their operations within the nation through competitive trade and taxation systems. This ensures a benefit for businesses not engaged in international trade.

DTA in Global Trade

Here is DTA’s role in global trade:

● DTA zones significantly contribute to global supply chains and global trade with stable export and import conditions within the domestic territory. It facilitates uninterrupted movement of goods without tax exemptions and additional regulations.

● Countries with a stable DTA facility often have the opportunity to develop trade agreements with other foreign countries. As a result, it boosts export-driven industries that focus on foreign territory in the country.

● With DTA systems present within the country, businesses can seamlessly distinguish goods produced for domestic and international markets. This helps avoid confusion pertaining to customs and tariffs.

Process of DTA Operation

DTA acts as a domestic market for goods production, consumption and trade under standard customs and tax regulations. While SEZs operate with incentives such as tax exemption and lower duties to facilitate export, DTA operates under regular trade and economic policies.

Here are the national trade policies under which businesses operate in DTA:

● Import and export are allowed under standard customs duties and taxes based on the country's trade laws.

● Goods and services in DTA zones are taxable under standard GST (Goods and Services Tax), import duties and other domestic taxes as DTA zones are not subject to tax exemptions, unlike SEZs.

● Businesses in DTA zones manufacture goods for domestic consumption as well as export. Notably, goods produced for export need to adhere to applicable customs regulations while moving out of the national border.

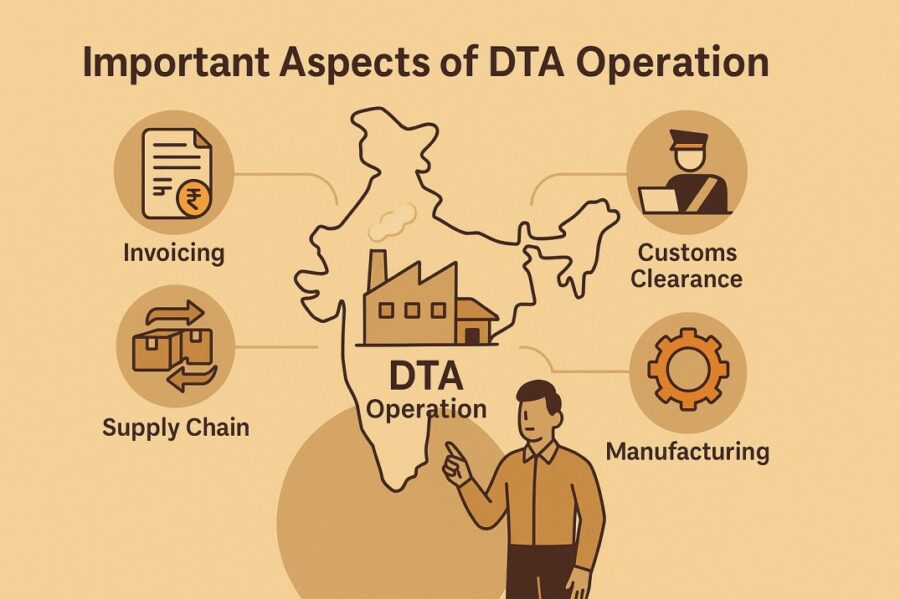

Important Aspects of DTA Operation

The following are the key aspects of DTA operation:

● Customs Duties: Goods that enter DTA zones need to comply with regular customs duties.

● Regulatory Compliance: Businesses need to follow regulations of the Customs Act, GST guidelines and Foreign Trade Policy.

● Taxation: Businesses in DTA zones need to comply with GST laws as no tax exemption applies.

● Key Stakeholders: The key stakeholders of DTA zones include business owners, government bodies, logistics companies and customs officers.

● Import/Export Process: Goods in DTA zones need to adhere to customs regulations for imports and exports for compliance.

● Enforcement Agencies: DGFT (Directorate General of Foreign Trade), Ministry of Commerce and CBIC (Central Board of Indirect Taxes and Customs) are the concerned enforcement agencies for DTA zones that regulate smooth operation and compliance with trade regulations.

Difference Between DTA, SEZ & EOU

Here are the differences between DTA, SEZ and EOU (Export Oriented Unit):

| Parameters | DTA | SEZ | EOU |

| Eligibility | Manufacturing and service-oriented units in India | Businesses established in Special Economic Zones | An EOU unit needs to be registered with the Directorate General of Foreign Trade (DGFT) |

| Regulatory Differences | DTAs need to comply with normal customs duties regulations | These are exempt from standard customs and excise duties | EOUs need to comply with SEZ export regulations |

| Tax Benefits | Standard tax rates applicable | Tax exemptions and incentives to boost exports | Duty-free imports to produce export goods |

| Regulations and Duties | Standard duties apply on imports and exports | Preferential duty treatment for exports | Manufactures goods solely for exports |

Benefits of DTA

Here are the features and benefits of DTA for different stakeholders:

Local Businesses:

Local businesses can enjoy lower operational costs with existing tax laws, ensuring standard taxation and reduced compliance needs for customs and regulations.

Exporters:

Exporters experience simplified customs processes for international trade wherein they can export goods without additional tax burden. Tax reductions on specific products are among other benefits for exporters.

Consumers:

Due to lower applicable taxes, consumers can avail goods at competitive prices with improved access and stable market conditions for the supply of goods.

Economy:

It boosts economic growth by generating employment opportunities and producing goods at the regional level.

Conclusion

Domestic Tariff Area under GST allows businesses to carry out production and consumption within the domestic market. It boosts economic growth by contributing to GDP (Gross Domestic Product) growth and employment generation.

Consumers can further avail goods at a reduced cost due to lower tax applicability. Ensure you check your eligibility to operate a business within DTA before you commence one in such a region. Notably, you can enjoy the benefits of lower operational costs for your business in DTA zones.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.